Money calculation skills Math Worksheets for Ages 5-6

3 filtered results

-

From - To

Enhance your child's money calculation skills with our engaging math worksheets designed specifically for ages 5-6. These interactive and colorful resources introduce young learners to the concepts of identifying coins, counting money, and simple transactions. Each worksheet is crafted to make math fun and accessible, fostering essential skills through enjoyable exercises. Your child will gain confidence and proficiency in recognizing and calculating different denominations while developing problem-solving abilities. Perfect for homeschooling, classroom activities, or supplementary practice, these worksheets are a valuable tool in instilling financial literacy from an early age. Download now and watch your child's math skills grow!

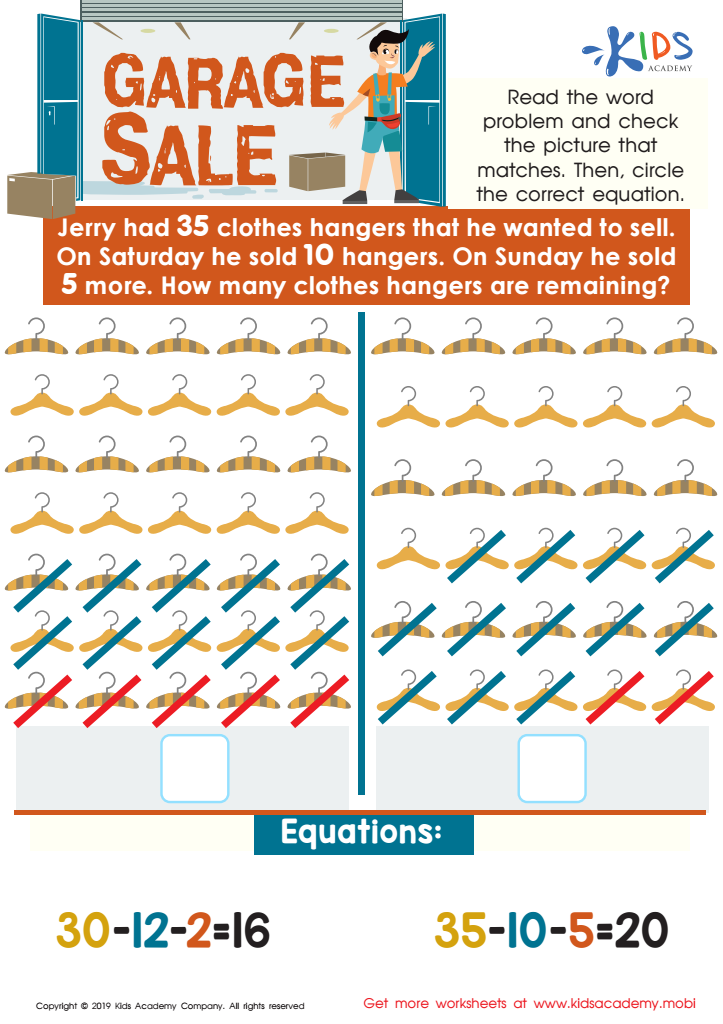

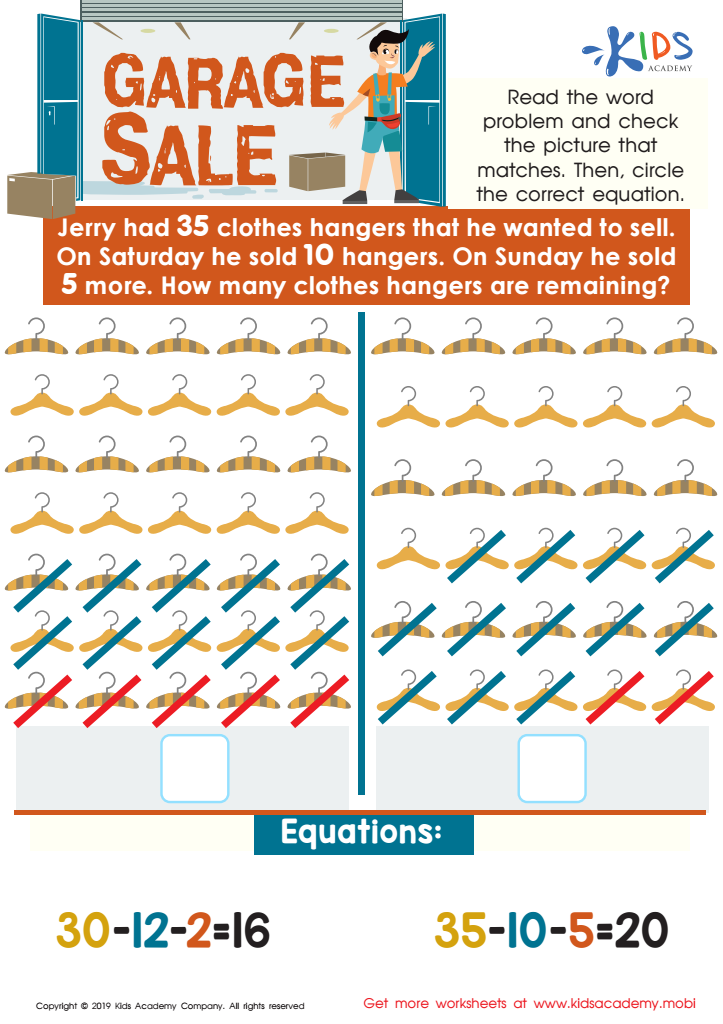

Garage Sale Worksheet

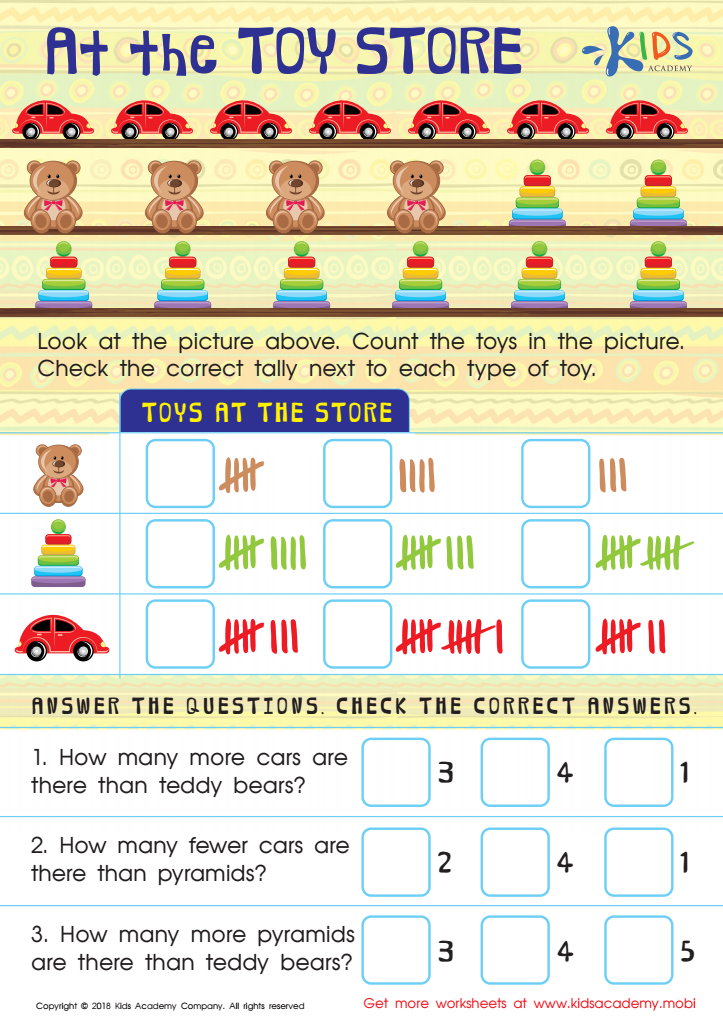

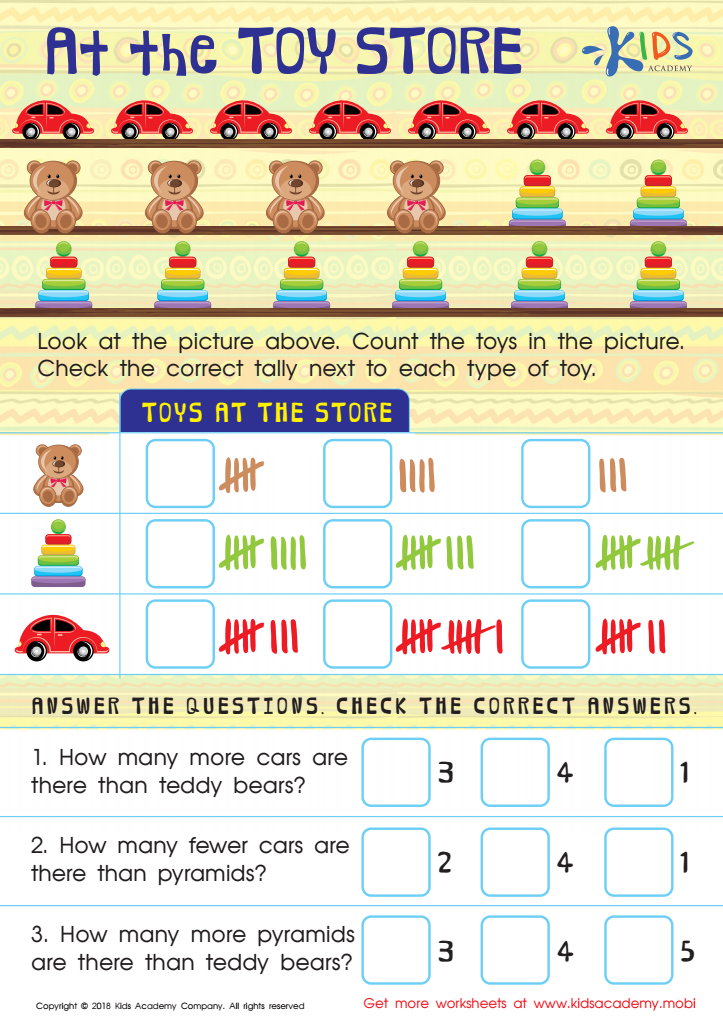

Tally Chart: At the Toy Store Worksheet

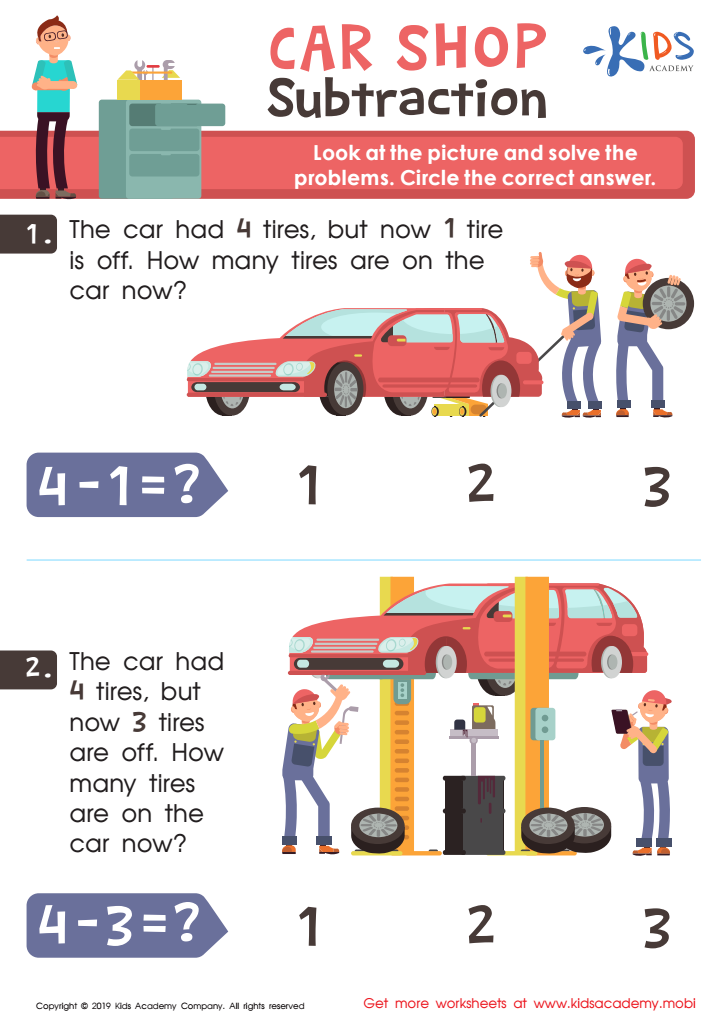

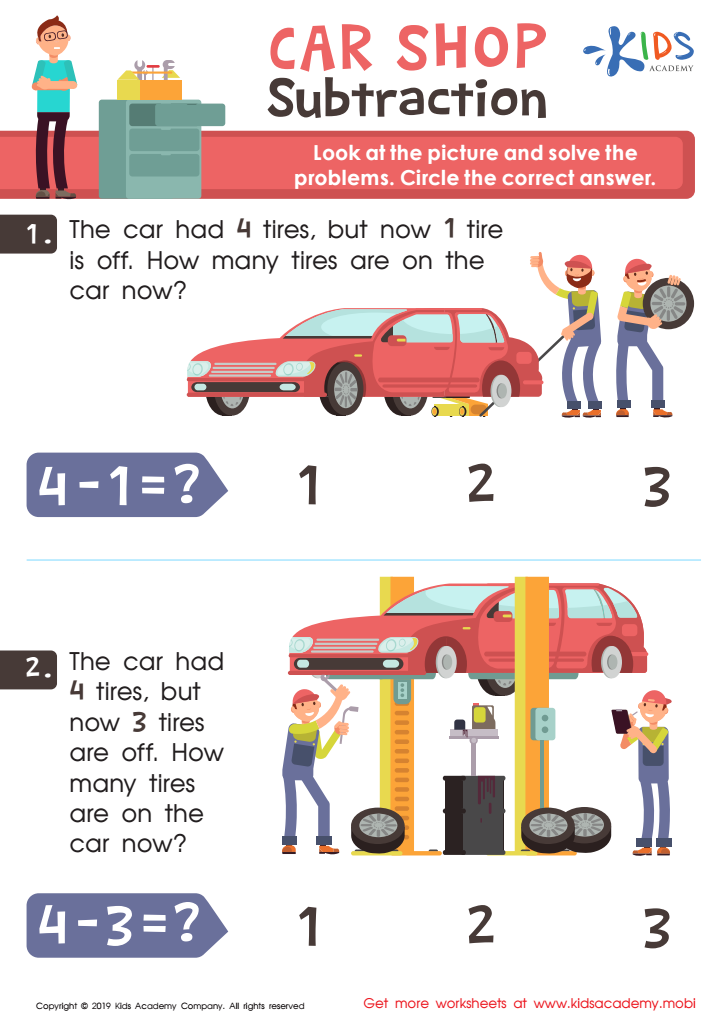

Car Shop Subtraction Worksheet

Parents and teachers should prioritize money calculation skills in young children, particularly those aged 5-6, as these skills lay the foundation for lifelong financial literacy. At this age, children are naturally curious about money, often observing transactions during shopping trips. Introducing basic concepts of counting, recognizing coins, and understanding the idea of exchange at this stage harnesses that curiosity and cultivates essential math skills.

Furthermore, money calculation skills nurture critical thinking and problem-solving abilities. When children learn to manage small amounts of money, they also develop skills such as comparing values, making decisions, and understanding the concept of budgeting—albeit in simple forms. These early lessons in basic financial concepts can reduce anxiety around money in the future, establishing healthy financial habits early on.

Additionally, reinforcing these skills encourages a positive relationship with math, often viewed with apprehension by many students. Engaging children with fun activities, like playing shop or using real coins, makes learning more enjoyable. By prioritizing money calculations at this developmental stage, parents and teachers can empower children with both mathematical and life skills, ensuring they are better equipped to navigate financial situations as they grow.

Assign to My Students

Assign to My Students

.jpg)

.jpg)