Understanding currency Math Worksheets for Ages 5-8

4 filtered results

-

From - To

"Understanding Currency Math Worksheets for Ages 5-8" offer engaging and educational activities to help young learners develop essential money-handling skills. These worksheets introduce children to various coins and bills, teaching them to identify, value, and count currency through fun exercises. With colorful illustrations and age-appropriate challenges, kids can practice making change, adding different denominations, and reinforcing their math skills. Perfect for use at home or in the classroom, these worksheets make learning about money interactive and enjoyable, laying a strong foundation for practical financial literacy. Start your child's journey to understanding currency today with these expertly designed resources.

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

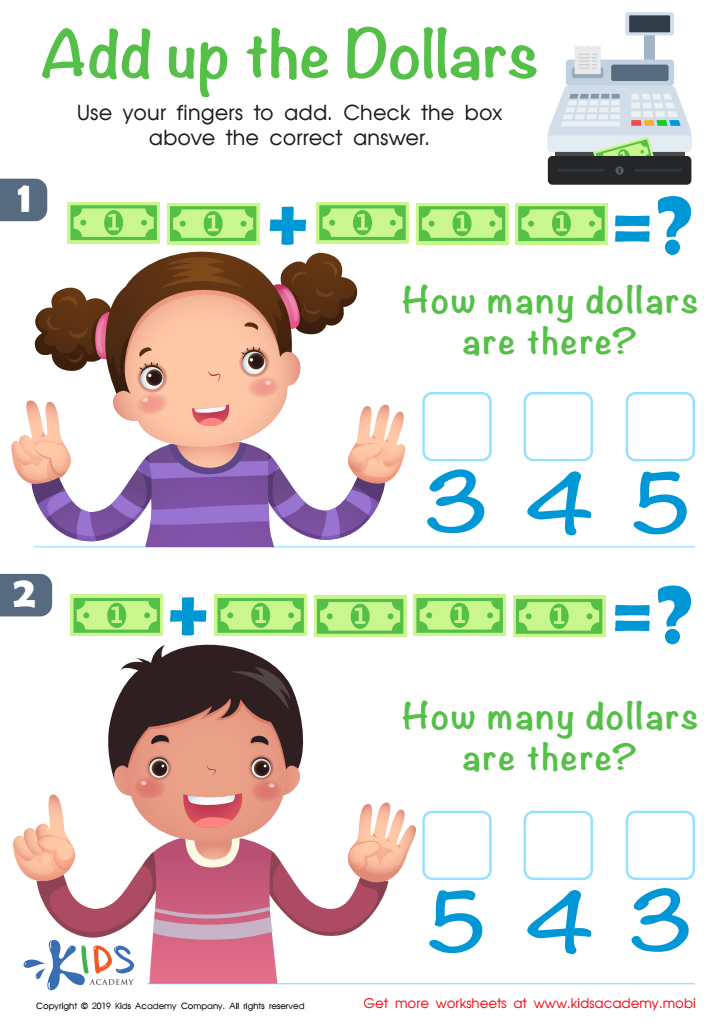

Add up the Dollars Worksheet

Understanding currency and basic math related to money is crucial for children aged 5-8 as it lays the foundation for essential life skills. At this age, kids are beginning to develop cognitive abilities needed for problem-solving and critical thinking. Teaching them about money helps them grasp the concept of value, addition, subtraction, and the importance of managing resources.

Early introductions to currency encourage financial literacy, which is increasingly important in today’s society. These lessons can shape responsible financial behaviors and help children understand the world around them. For example, counting coins and bills can enhance their mathematical skills, giving practical applications to abstract concepts learned in the classroom.

For parents and teachers, integrating currency math into everyday activities can make learning more engaging and relevant. When children understand how money works, they're better equipped to make informed decisions, whether they’re handling allowance money or planning how to save and spend. This not only builds arithmetic skills but also fosters independence, self-confidence, and responsibility.

Ensuring that children aged 5-8 grasp currency math provides them with a valuable toolkit for both their immediate educational needs and their long-term personal and economic well-being. By understanding money early on, they can better navigate growth and be prepared for more complex financial concepts in the future.

Assign to My Students

Assign to My Students