Understanding economics Worksheets for Ages 7-8

3 filtered results

-

From - To

Introduce young learners to the world of economics with our "Understanding Economics Worksheets for Ages 7-8". These engaging, age-appropriate worksheets help children grasp fundamental economic concepts by exploring topics like goods and services, supply and demand, and financial decision-making. Designed to be both educational and fun, the activities include puzzles, word games, and real-life scenarios to enhance your child's learning experience. By fostering early knowledge of economics, these worksheets empower children with critical thinking skills and a solid foundation for future financial literacy. Dive into our creative resources and make learning economics an exciting adventure for your young one today!

Human and Capital Resources Worksheet

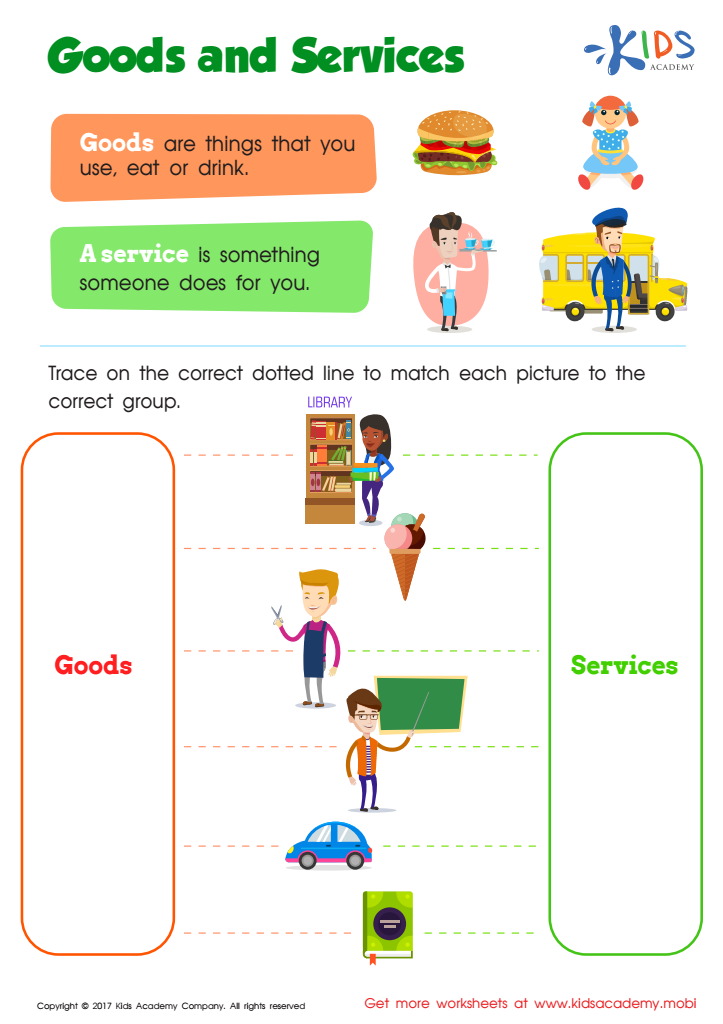

Goods and Services Worksheet

Understanding economics at ages 7-8 is fundamental for helping children develop essential life skills that shape their future decision-making. At this developmental stage, youngsters are highly receptive to new ideas and motivations, making it a prime time for initiating fundamental economic concepts. By introducing basics like saving, spending, and choosing between needs and wants, children learn the value of money and the importance of making thoughtful choices.

Incorporating economic education teaches responsibility and delaying gratification—crucial aspects for developing self-control and long-term planning. This foundation can improve not just financial literacy but also enhance math and critical thinking skills, turning abstract numbers into relatable and actionable knowledge. Furthermore, understanding economics encourages problem-solving and decision-making abilities by allowing children to explore concepts like budgeting within the context of everyday scenarios, such as using an allowance or choosing between toys.

Parents and teachers play a key role by blending these lessons into daily activities and conversations, fostering a positive attitude towards smart money management. Equipping children early with economic understanding reduces financial illiteracy, empowering them to become knowledgeable consumers and judicious planners. Ultimately, these skills contribute to their overall personal development, laying the groundwork for a financially responsible future.

Assign to My Students

Assign to My Students