Normal Money Worksheets for Ages 8-9

1 filtered results

-

From - To

Introducing our specially curated Normal Money worksheets, tailor-made for young learners ages 8-9! Designed to demystify the concepts of money management, these worksheets blend fun with education, helping children grasp the basics of financial literacy at an early age. Covering a range of topics from identifying coins and bills to understanding simple transactions, our Normal Money worksheets are the perfect tool to embolden your child's mathematical confidence. Through engaging activities and real-life scenarios, children will learn the value of money, budgeting, and saving. Dive into our Normal Money worksheets and set the foundation for a lifetime of financial savvy!

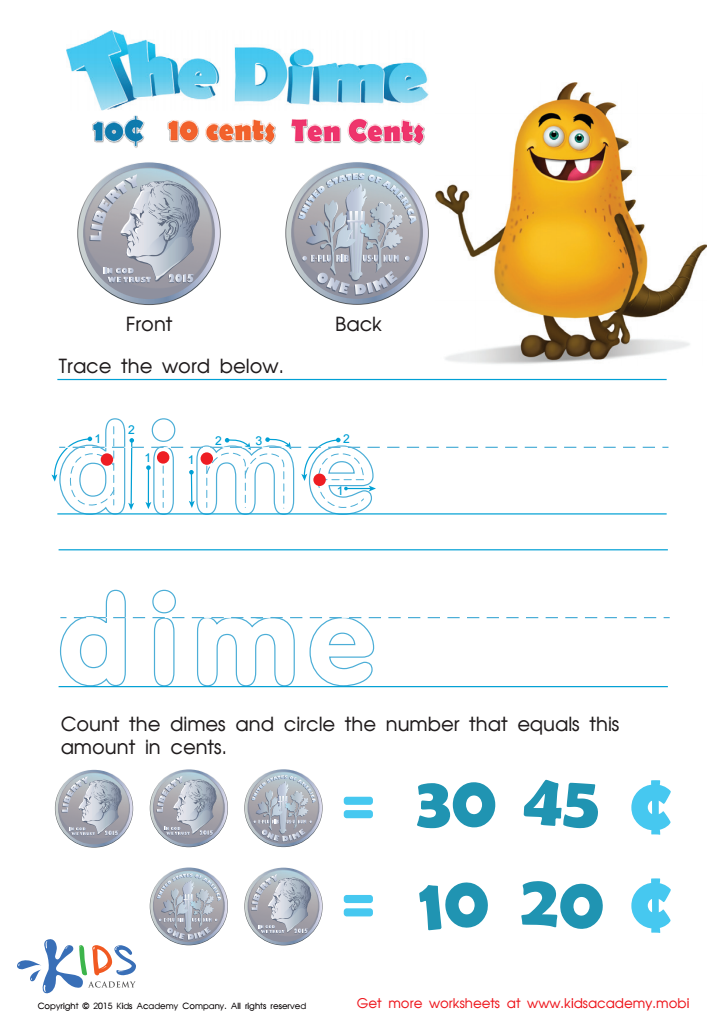

Ten Cents or the Dime Money Worksheet

Normal Money worksheets for Ages 8-9 play a crucial role in laying down the foundation for financial literacy among young learners. At this developmental stage, children are becoming more curious and observant about the world around them, including the concept of money and its significance in everyday life. These specially designed worksheets serve as an engaging and educational tool that introduces them to the basics of money management, including earning, saving, spending, and even simple budgeting.

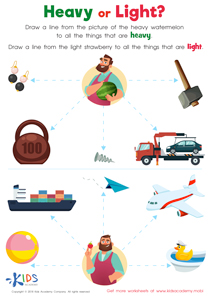

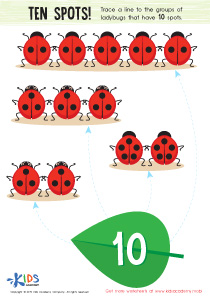

Through a variety of activities, such as identifying coins and bills, simple addition and subtraction of amounts, and understanding the value of money, these worksheets make learning about finances an enjoyable process. They are tailored to meet the cognitive and developmental needs of 8 to 9-year-olds, ensuring that the concepts are easily understandable and relevant to their everyday experiences. This hands-on approach not only enhances their mathematical skills but also instills a sense of responsibility and the importance of making informed financial decisions from a young age.

Moreover, Normal Money worksheets for Ages 8-9 encourage problem-solving and critical thinking skills, as children learn to navigate through various money-related scenarios presented in these exercises. By integrating these essential life skills early on, we are preparing our children for a future where they are confident, financially savvy individuals.

Assign to My Students

Assign to My Students

.jpg)