Understanding currency Extra Challenge Money Worksheets for Ages 3-6

3 filtered results

-

From - To

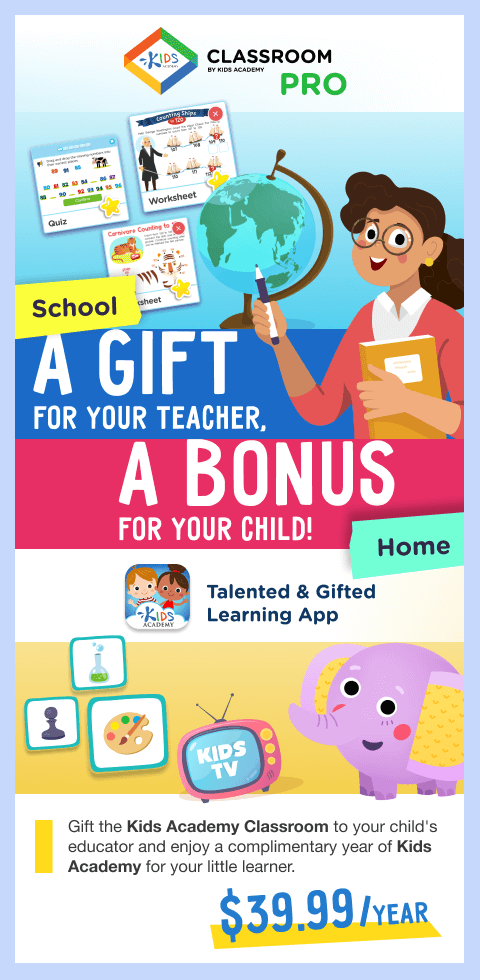

Enhance your child's financial literacy with our 'Understanding Currency Extra Challenge Money Worksheets for Ages 3-6'. These engaging and educational worksheets, designed by Kids Academy, provide an excellent foundation in recognizing different coins, bills, and their values. With visually appealing and age-appropriate activities, young learners will enjoy counting, matching, and identifying various currency formats. Perfect for both classroom and home use, these worksheets support early math development and practical life skills. Ensure your preschoolers and kindergarteners gain confidence in handling money through fun, interactive challenges tailor-made for their developmental stage.

Counting Coins Worksheet

Five Cents or the Nickel Money Worksheet

Money: Coins Dollars Printable

Understanding currency at an early age lays a critical foundation for financial literacy. When parents or teachers introduce concepts of money to children aged 3-6, they are instilling important life skills that have lasting benefits. At this stage, children are naturally curious and eager to explore new ideas. By teaching them about currency, they begin to understand the value of goods, services, and savings, which can foster smart financial habits early on.

The Extra Challenge Money activities can be particularly effective for this age group. These activities often involve counting coins, recognizing different denominations, and simple transactions, which can sharpen their mathematical skills. Engaging in hands-on, playful experiences helps reinforce these concepts in a fun and meaningful way, making learning both memorable and enjoyable.

Moreover, developing an understanding of currency at this young age promotes responsibility and decision-making. For instance, through role-playing scenarios like a grocery store or a lemonade stand, children learn about making choices within a budget, the importance of saving, and even basic economic principles like earning and spending.

Incorporating currency education helps bridge the gap between abstract numerical concepts and real-world applications. It empowers children with knowledge, preparing them for more complex financial literacy topics in the future and, ultimately, contributing to their overall cognitive and social development.

Assign to My Students

Assign to My Students