Financial literacy Extra Challenge Worksheets for Ages 4-7

3 filtered results

-

From - To

Welcome to our Financial Literacy Extra Challenge Worksheets for Ages 4-7! Designed to cultivate essential money skills early, these engaging worksheets make learning about finances fun. Children will explore concepts like saving, spending, and sharing through interactive activities tailored for young minds. Each worksheet promotes critical thinking and decision-making, introducing ideas like budgeting and the value of money. Ideal for at-home learning or classroom use, these resources encourage discussions about financial responsibilities in an age-appropriate manner. Equip your child with the foundations of financial literacy to help them make informed choices and develop positive money habits for a lifetime!

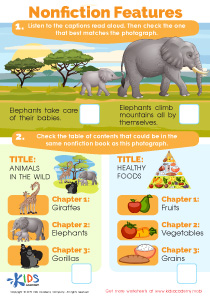

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy is crucial for children as young as 4-7 for several compelling reasons. First, early education about money helps cultivate responsible attitudes towards spending, saving, and sharing. This foundational knowledge builds essential life skills that they will carry into adulthood.

Secondly, understanding financial concepts empowers kids to make informed decisions. Lessons on money management can be introduced through fun and engaging activities tailored to their age, turning abstract concepts into relatable experiences. For example, using play money during games can illustrate the value of coins and the basics of trade.

Moreover, children who grasp financial literacy tend to develop better problem-solving skills and higher levels of critical thinking. They learn to set goals, budget for desired toys or experiences, and understand the concept of trade-offs.

Finally, by instilling financial literacy early, parents and teachers help reduce future financial anxieties. Children equipped with this knowledge are more likely to grow into adults who can navigate financial challenges with confidence and ease. Communities benefit as well, since financially savvy individuals contribute positively to the economy. By prioritizing financial literacy, educators and parents empower the next generation to secure healthier financial futures.

Assign to My Students

Assign to My Students