Financial literacy Extra Challenge Coins Worksheets for Ages 8-9

3 filtered results

-

From - To

Introduce your 8 to 9-year-olds to the world of financial literacy with our "Extra Challenge Coins Worksheets." These engaging worksheets are designed to build critical math and money-handling skills through fun activities featuring coins. Perfect for young learners, our printable resources help children understand the value of money, enhance their counting abilities, and develop problem-solving skills, laying a strong foundation for smart financial habits. Explore an array of exercises that teach kids how to identify, add, and compare coins in real-life scenarios. Empower your child with the essential knowledge they need for a financially savvy future.

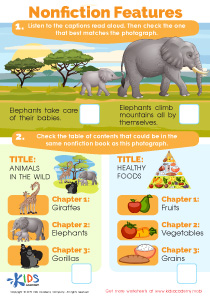

How Many Coins Money Worksheet

Five Cents or the Nickel Money Worksheet

Picking the Coins You Need Money Worksheet

Financial literacy Extra Challenge Coins can play a transformative role in shaping the financial futures of children aged 8-9, which makes them an invaluable tool for both parents and teachers. At this critical developmental stage, children are beginning to form their understanding of money and financial principles. They are able to grasp basic concepts like earning, saving, budgeting, and spending but often learn best through engaging and interactive methods.

Extra Challenge Coins provide a tangible, exciting way for children to learn about these concepts. They turn abstract ideas into concrete rewards, making the learning experience both meaningful and memorable. When children earn coins for accomplishing small financial tasks or challenges, they learn the value of goal-setting and delayed gratification, foundational skills for sound financial management in the future.

Moreover, early financial education has been shown to yield long-term benefits, including better financial decision-making, reduced incidence of debt, and a greater sense of financial security in adulthood. By incorporating Challenge Coins into their learning, parents and teachers can effectively build a child's confidence and competence in handling money. This proactive approach empowers children, fostering a sense of responsibility and making them less likely to encounter financial difficulties later in life.

For these reasons, prioritizing financial literacy at this young age through these engaging tools is a wise investment in a child's future economic well-being.

Assign to My Students

Assign to My Students