Money worksheets activities for Ages 5-6

1 filtered results

-

From - To

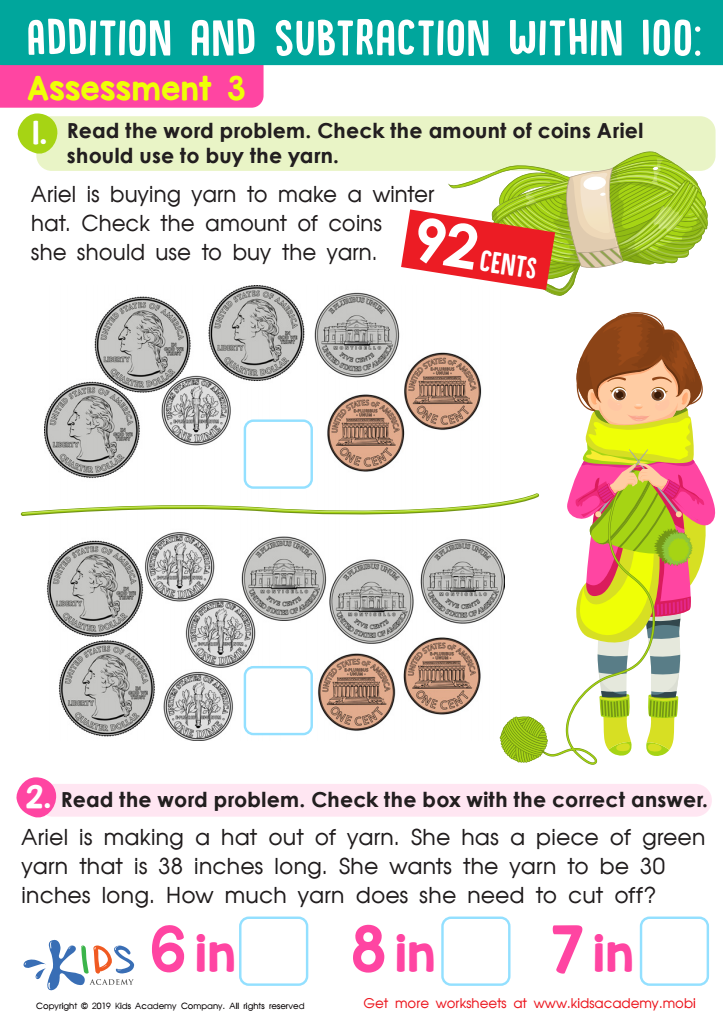

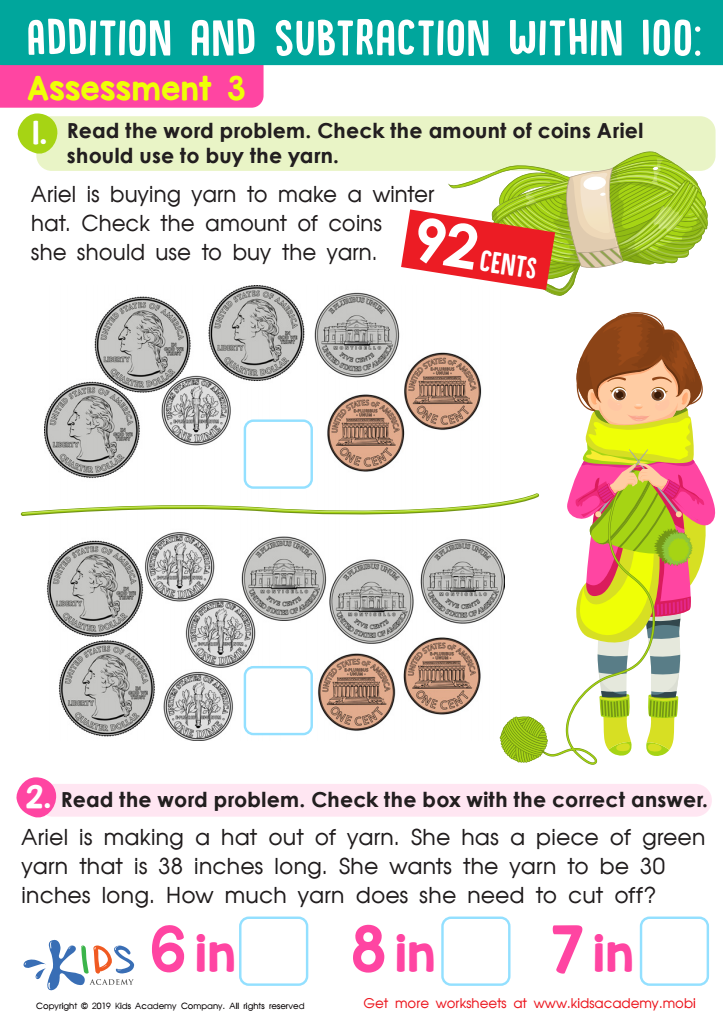

Assessment 3 Math Worksheet

Money worksheets activities are an invaluable resource when it comes to teaching children and students about the complex world of finance and economics. These interactive and engaging tools not only make learning about money fun but also instill crucial life skills that will serve learners well into adulthood. Let's delve into why money worksheets activities are so beneficial.

First and foremost, money worksheets activities provide a hands-on learning experience. They allow students to practice real-world scenarios, such as making change, budgeting, and understanding the value of different denominations of currency. This practical approach to learning ensures that students can apply what they learn in real-life situations, which is the ultimate goal of financial literacy education.

Secondly, these activities are incredibly versatile. They can be tailored to suit a wide range of age groups and learning levels, making them a perfect fit for diverse classrooms. For younger children, the focus can be on identifying and counting money, while older students might tackle more challenging concepts like interest rates, saving strategies, and investment basics. This adaptability ensures that every learner can benefit from the exercises, regardless of their prior knowledge or experience with money matters.

Additionally, money worksheets activities encourage critical thinking and problem-solving skills. As students navigate through different financial dilemmas and scenarios presented in the worksheets, they are forced to think critically about the best course of action. This not only enhances their financial literacy but also develops their overall cognitive abilities, preparing them for complex decision-making situations they will face in the future.

In summary, money worksheets activities are a crucial component of a comprehensive education on financial literacy. Through interactive learning, versatility, and the development of critical thinking skills, these activities equip learners with the knowledge and confidence needed to manage money effectively, paving the way for a financially secure future.

Assign to My Students

Assign to My Students