Money recognition Grade 2 Math Worksheets

8 filtered results

-

From - To

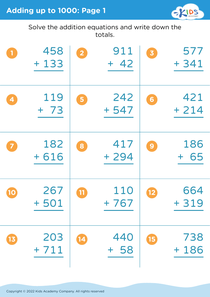

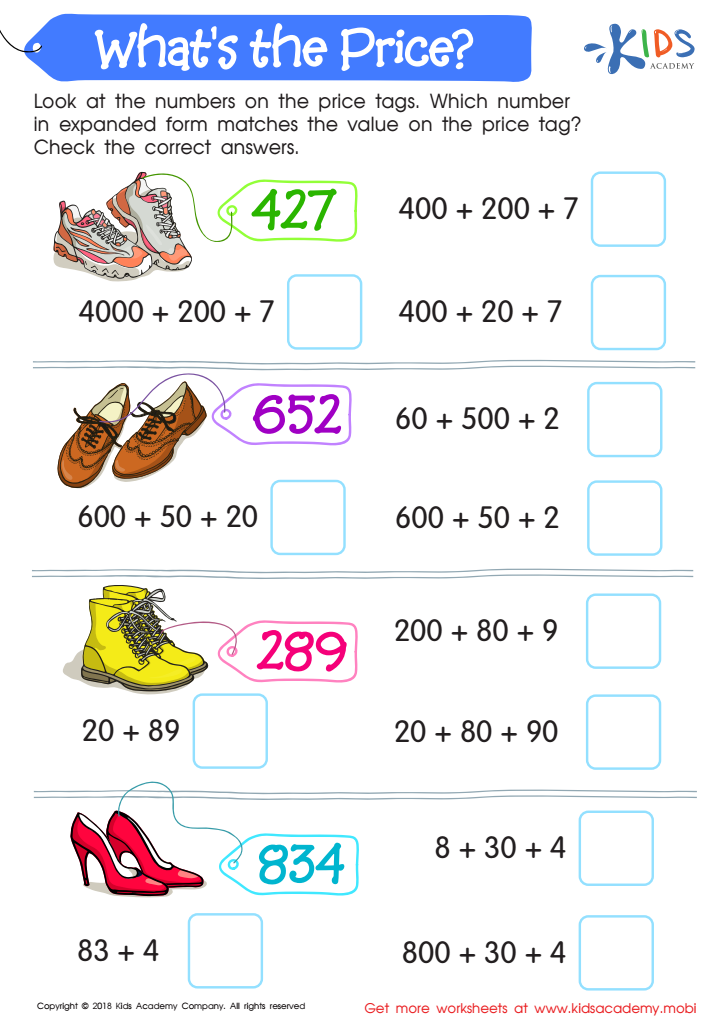

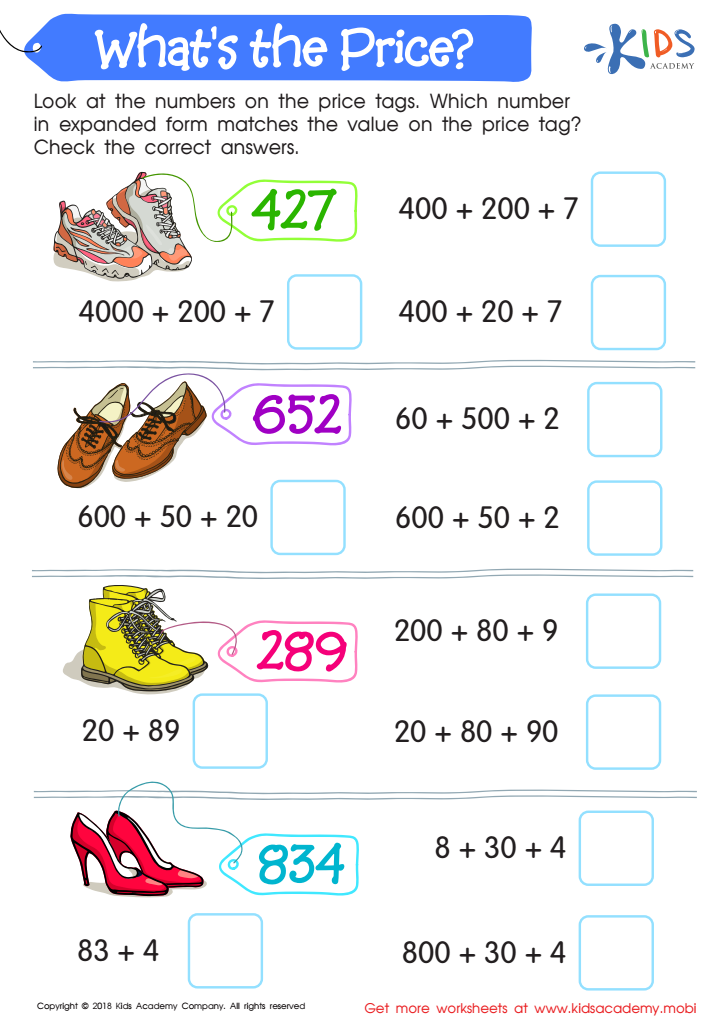

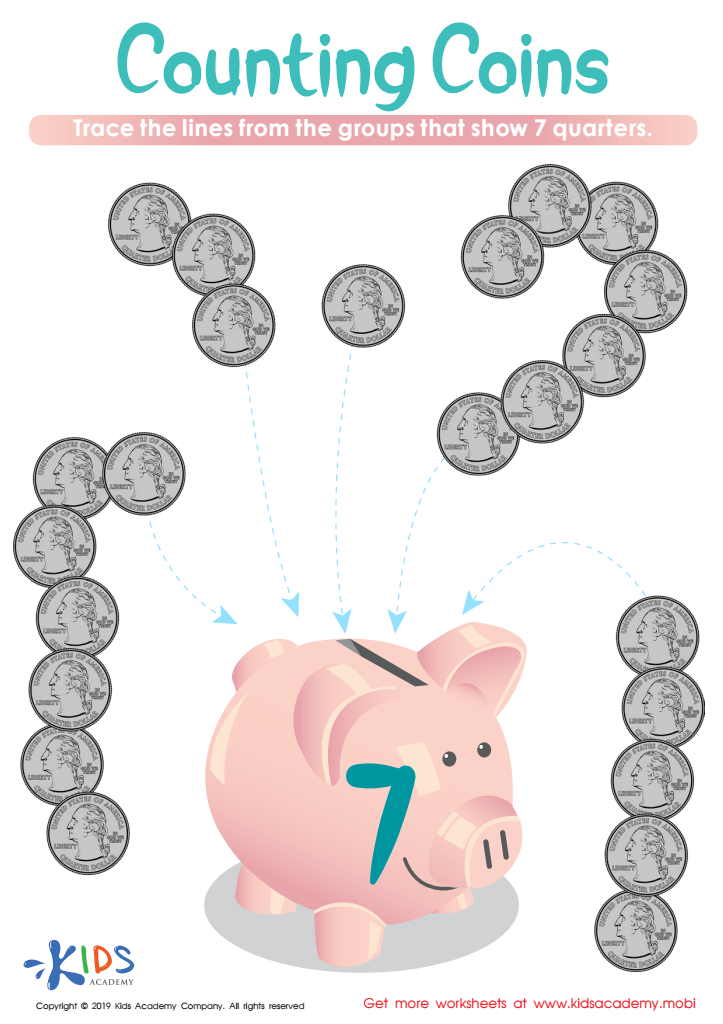

Enhance your Grade 2 students' understanding of money with our engaging Money Recognition Math Worksheets! Designed to build essential financial literacy, these worksheets provide lively activities that help kids identify coins, understand their values, and make change confidently. Featuring colorful illustrations and relatable scenarios, our resources help reinforce lessons on counting money, adding values, and solving real-world problems. Perfect for both classroom use and home practice, our worksheets cater to various learning styles, ensuring that every child grasps fundamental money concepts effectively. Support your second grader's math skills today by exploring our comprehensive collection tailored for young learners!

What's the Price? Worksheet

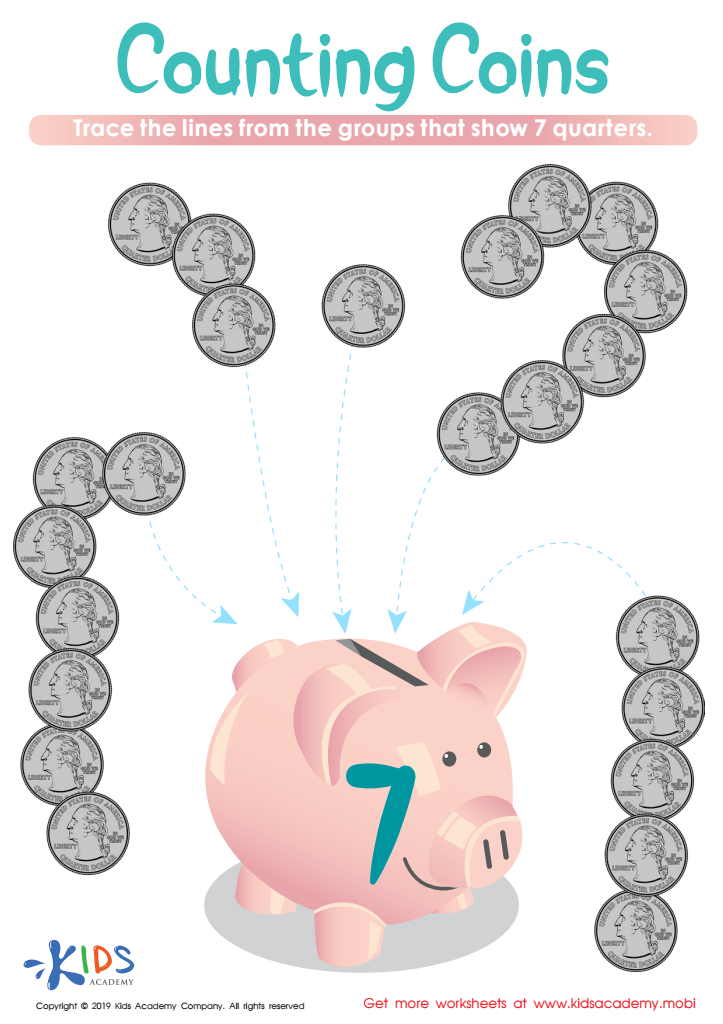

Counting Coins Worksheet

How Many Coins Money Worksheet

One Cent or the Penny Money Worksheet

Coin Names and Values Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Money recognition is an essential skill for second graders that lays the foundation for financial literacy and practical life skills. At this grade level, children begin to learn the values of different coins and notes, understanding how to identify, count, and utilize money in everyday situations. Here are key reasons why parents and teachers should prioritize money recognition in Grade 2 math.

Firstly, developing money recognition skills fosters critical thinking and math fluency. It challenges students to solve problems involving counting and making change, honing their calculation abilities. Secondly, this skill promotes independence; children gain confidence when they can manage small amounts of money, whether it’s making purchases in a classroom store or planning for transactions during outings.

Next, understanding money helps children grasp the concept of value. They learn to differentiate between necessary purchases and wants, which is integral to developing responsible spending habits later in life. Moreover, financial literacy—including recognizing money—sets the stage for understanding broader economic concepts as they progress in school.

In essence, teaching money recognition not only equips students with practical skills for today but also instills a sense of financial responsibility for their future. This empowers them to navigate financial transactions with ease as adults.

Assign to My Students

Assign to My Students