Understanding money Grade 3 Math Worksheets

4 filtered results

-

From - To

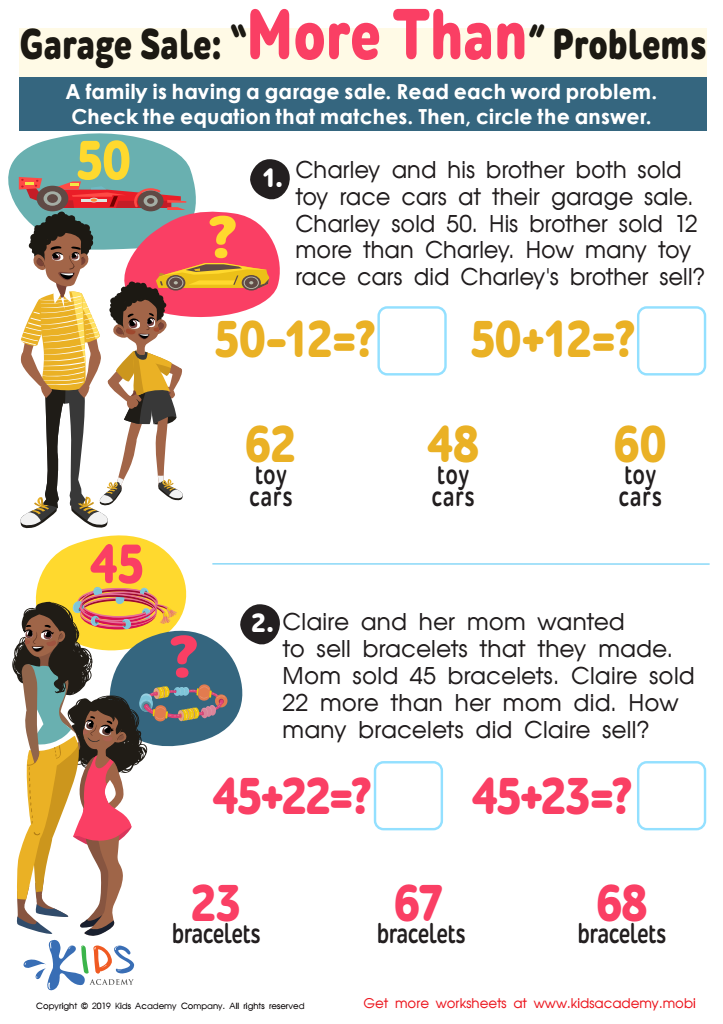

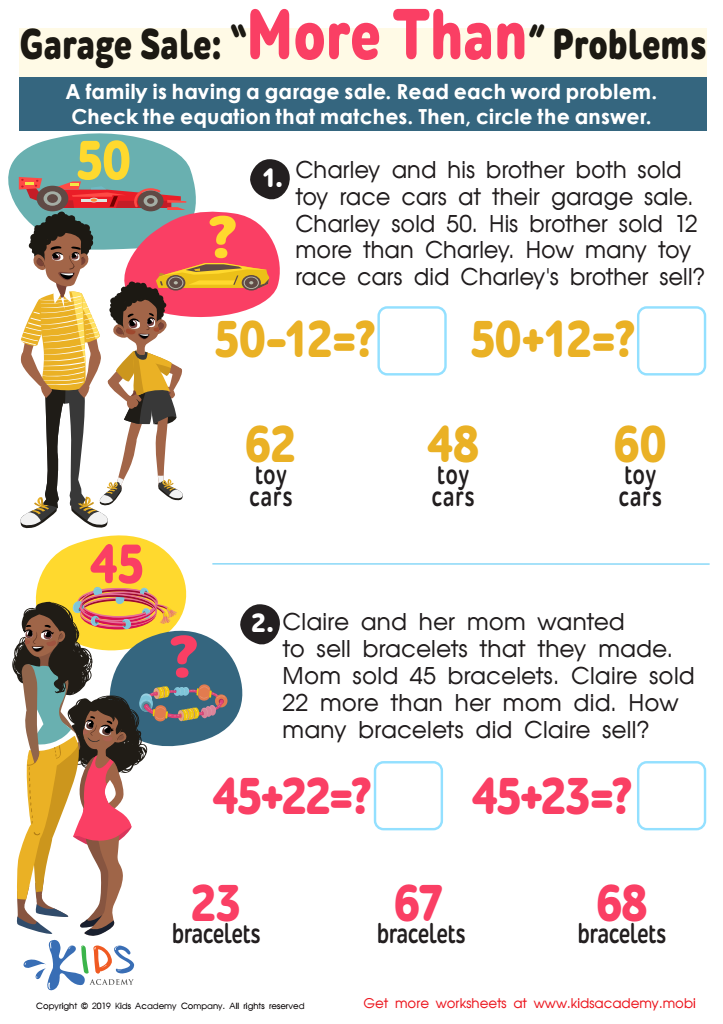

Our "Understanding Money" Grade 3 Math Worksheets are designed to teach your child essential money skills while making learning fun and engaging. Through interactive exercises, students will master identifying coins, counting money, and solving real-world problems involving purchases and change. These thoughtfully designed worksheets support practical knowledge, preparing kids for everyday financial decisions. Perfect for home practice or classroom use, they cater to various learning styles with visually appealing and easy-to-follow tasks. Help your third grader build a solid foundation in financial literacy and math confidence with our comprehensive, educational resources.

Garage Sale - More yhan Worksheet

Sweet Shop – Counting Coins Worksheet

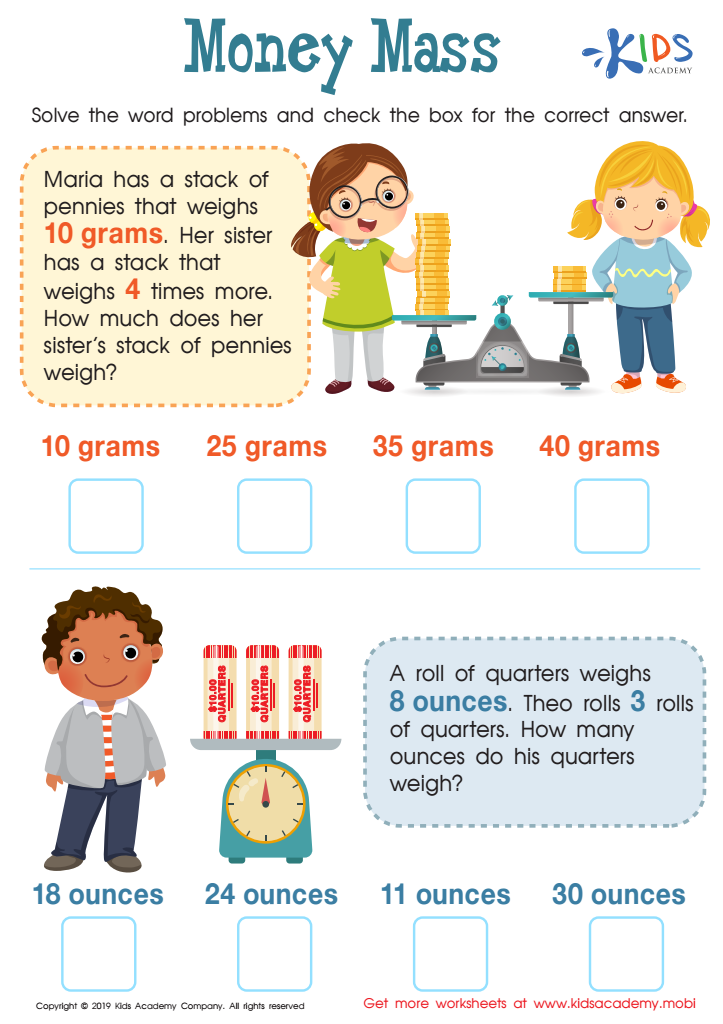

Money Mass Worksheet

Understanding money is a crucial skill for Grade 3 students, and it is important for parents and teachers to prioritize its teaching for several reasons. First, it lays the foundation for financial literacy. Young learners who grasp the value of money, including coins and bills, and the basics of buying and selling can make informed financial decisions in the future.

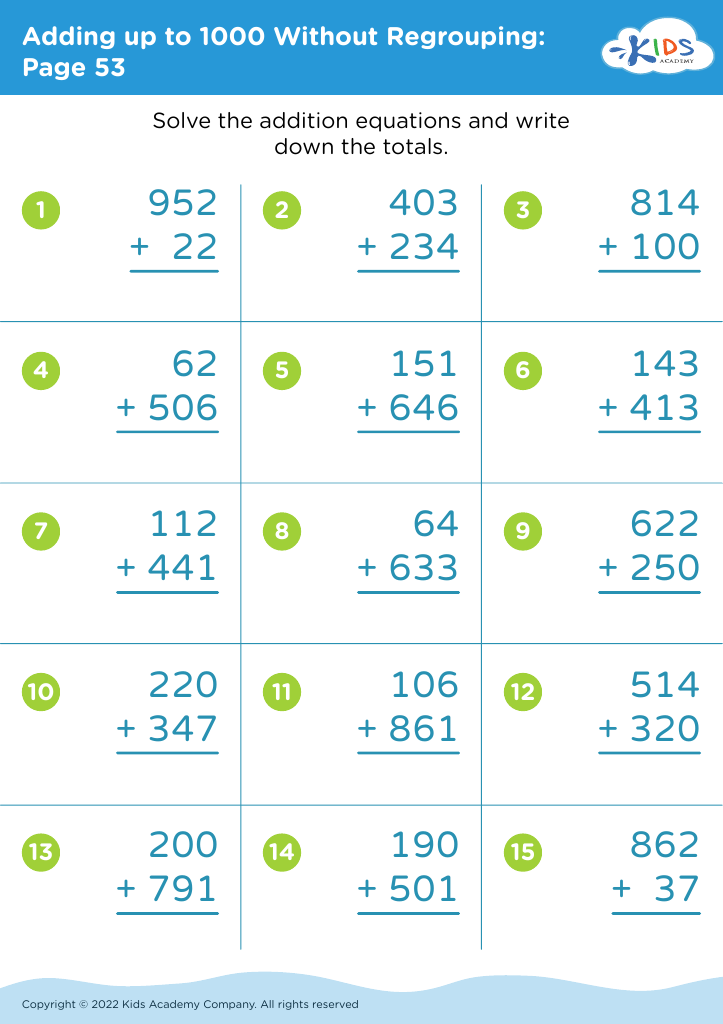

Furthermore, learning about money enhances math skills. Concepts such as addition, subtraction, multiplication, and division all come into play when calculating totals, making change, and budgeting. This practical application of math helps solidify these crucial mathematical operations in a real-world context.

Additionally, understanding money instills a sense of responsibility. Students learn about earning, saving, and spending wisely, which encourages prudent financial habits early on. This responsibility also teaches them the value of hard work and the importance of setting priorities.

Lastly, money is an integral part of daily life. From managing allowances to understanding the cost of goods and services, a child equipped with money skills navigates the world more confidently and independently. Parents and teachers who emphasize the importance of money management in Grade 3 set the stage for well-rounded, financially savvy individuals. By investing in this aspect of education, they are paving the way for a lifetime of financial security and informed decision-making.

Assign to My Students

Assign to My Students